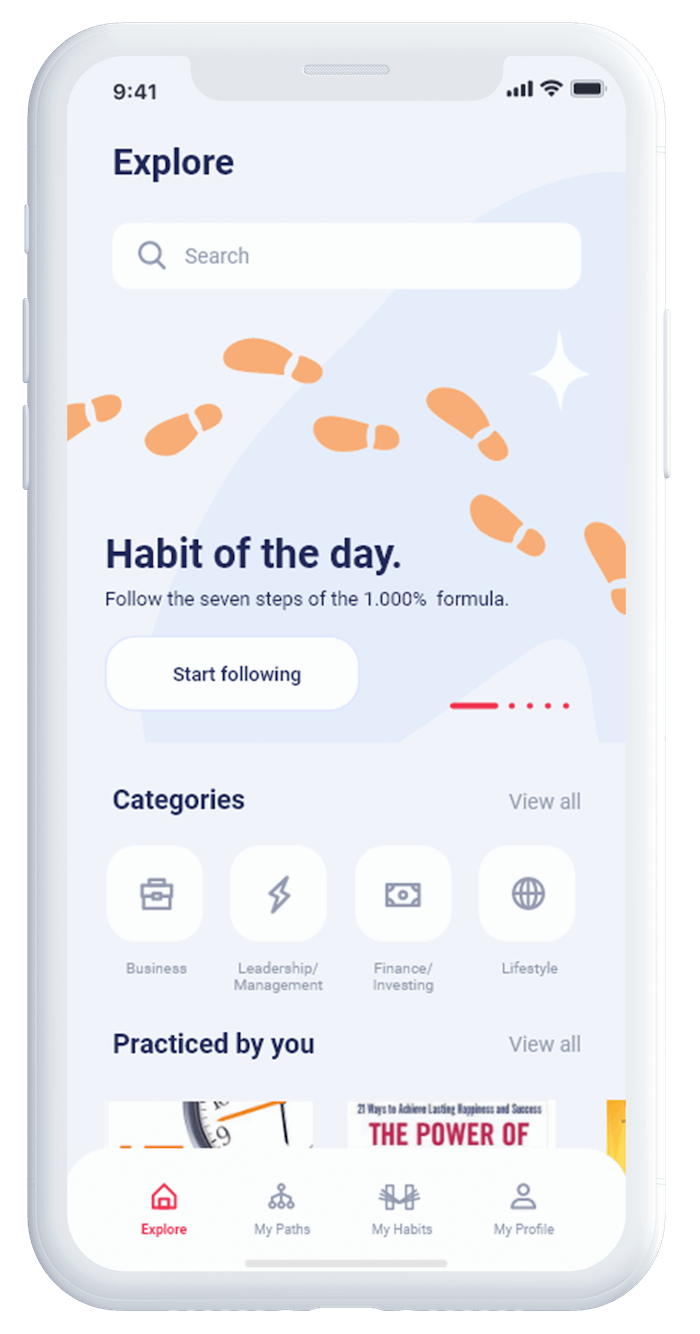

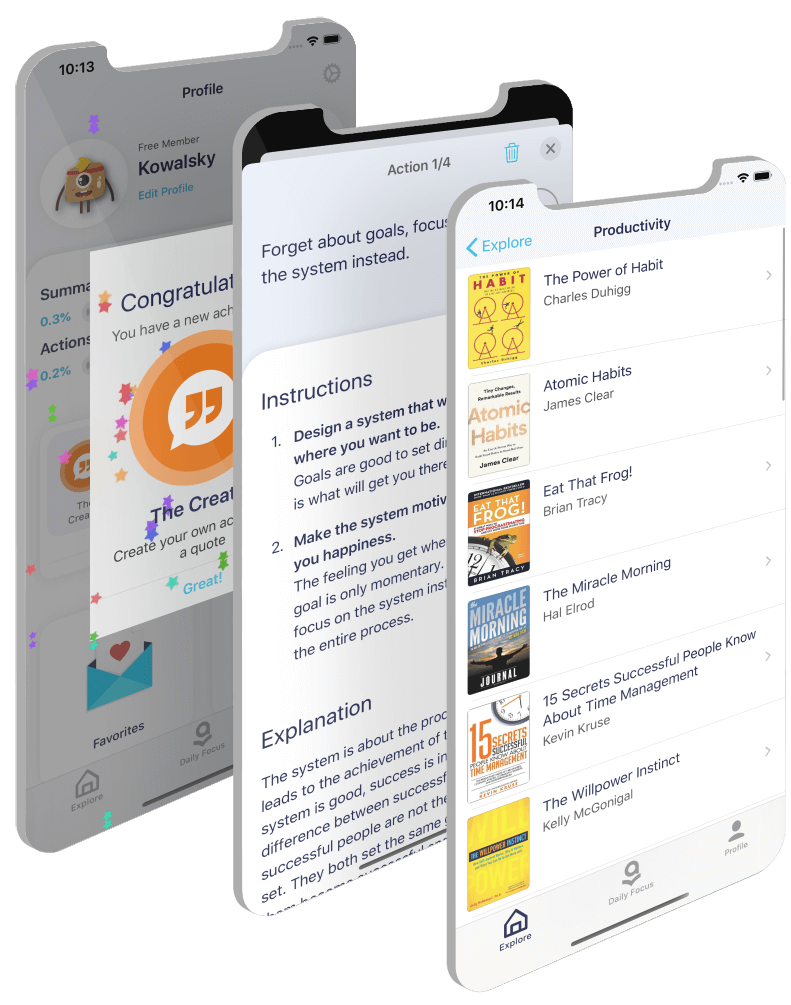

I Will Teach You to Be Rich: No Guilt. No Excuses. No BS. Just a 6-Week Program That Works

by Ramit SethiI Will Teach You to Be Rich provides you with a comprehensive program to help you take control of your finances and build wealth. It offers practical advice on how to invest, save, and spend money in a way that will lead to financial freedom. Backed with real-life examples of how others have used the program to achieve their financial goals, you’ll learn how to create a rich life that allows you to take vacations, pay off debt, and build retirement funds - all without any financial worries.

Start Investing Early

Starting to invest early is essential for securing a successful financial future. Take the story of Smart Sally and Dumb Dan, for example.

Smart Sally and Dumb Dan are both 35 and 45 years old, respectively. They both invest $200/month for 10 and 20 years, respectively, at an 8 percent rate of return. At age 65, Sally's account is worth $181,469, while Dan's is worth $118,589, resulting in a $60,000 difference. This clearly illustrates how crucial it is to begin investing early.

But the problem is, many people lack knowledge about investing, and the media doesn't always provide beneficial information. They tend to focus on topics that generate page views and sell ads. Also, there's been a rise in victim culture, where people compete to establish who has suffered the most. Instead of fixating on their setbacks, people should concentrate on what they can manage and not give up easily after experiencing initial failures.

If you want to be a successful investor in the long term, you have to learn two main things: implementing the 85 Percent Solution and accepting mistakes.

The 85 Percent Solution emphasizes the significance of starting, even if you're not an expert. Here, it's preferable to start taking action and making 85% progress toward your financial goals, even if you can't do it perfectly. After all, it's always better to make mistakes with a small amount of money now, so when you have more, you'll have a better understanding of what to avoid.

Remember that investing should be viewed as a boring yet profitable long-term strategy. Many individuals think that investing is just about purchasing stocks and become lost in complicated terms like "hedge funds," "derivatives," and "call options." In reality, investing isn't only about selecting stocks. And having a solid investment plan is more important than any individual investment choice. At the end of the day, simple, long-term investment strategies work best.

Actions to take

Optimize Your Credit Cards to Outsmart Companies

Credit cards can be a great way to get access to a lot of benefits, such as free warranty extensions, free rental car insurance, rewards, and points worth hundreds or even thousands of dollars.

However, if you don't pay off your balance at the end of the month, you will be charged a high-interest rate, usually around 14%. It's also easy to overspend and find yourself in debt.

To get the most out of credit cards, you need to be smart and strategic. Negotiate with credit card companies, take advantage of hidden perks, and maximize rewards and cash back. With the right approach, you can outsmart the credit card companies and get the most out of your credit cards.

Actions to take

Switch Banks for Financial Security

People often stay with the same bank for years, even though they know they are getting a bad deal. To avoid this, it is important to research the banks' past practices and opt for those that provide superior services and no fees.

While switching banks might appear cumbersome, it is a wise decision in the long run. There are plenty of banks out there that are more convenient, cheaper, and offer better rewards than the big banks. Plus, it only takes one day to make the switch, and you'll be on your way to growing your income with the best of them!

Actions to take

Investing is a Key to Financial Success

Albert Einstein famously said compounding is the greatest invention in human history because it enables us to accumulate wealth systematically and reliably. Ramit Sethi goes on to add that investing, despite appearing intimidating, can be an effortless process.

Over the course of the twentieth century, the average yearly return of the stock market was 11%, with inflation accounting for a 3% reduction in earnings, resulting in a net 8% return. Consequently, investing funds can yield an 8% return over the long haul after adjusting for inflation.

Many people are put off investing due to a lack of education, too much information, convoluted messages from the media, or simply a lack of interest. However, the key to getting rich is to control spending, regularly invest, and, in some cases, become an entrepreneur.

Actions to take

Conscious Spending

We may not realize it, but most of us tend to spend more on our cell phones and shoes than our grandparents did on their cars. We fail to realize how quickly these expenses can accumulate, and despite feeling remorseful about buying something, we still make the purchase.

Instead of adhering to a strict budget, it's beneficial to establish a Conscious Spending Plan. It's a much more flexible approach to managing your money. With this plan, you can automate your savings and investments while making your spending decisions much simpler. The idea is to spend money on the things you love and cut back on the things you don't.

Unfortunately, most of us were never taught how to spend consciously, so we end up trying to cut costs on everything, which just leads to feeling guilty when we can't stick to it. With conscious spending, you'll no longer have to struggle with this. Using this approach, you'll learn to choose the things you really care about and spend extravagantly on them while cutting costs on the things you don't love.

Actions to take

Automate Your Finances

Ryan Lett, a 38-year-old, has been utilizing the Automated Money Flow system for the past eight years, and he's seen remarkable results. The beauty of automating your finances is that it enables you to save for important life events such as retirement, weddings, and emergencies without having to think about it constantly. Additionally, it helps you establish the habit of investing regularly every month.

Moreover, it leverages human psychology's power, allowing you to concentrate on the bigger picture. With this system, you can use your money to create memories and experience true joy without any financial stress.

Actions to take

Investing in Index Funds is Better than Mutual Funds

Investing in the stock market is a challenging endeavor that requires careful consideration. Despite the many financial "experts" who make predictions about the market, accurately forecasting its direction remains elusive.

In fact, even fund managers also make mistakes. They often make hasty decisions, such as selling too quickly, trading excessively, and making arbitrary guesses. And while mutual funds use active management, where a portfolio manager attempts to pick the best stocks and give you the best return, it usually comes with a hefty price tag. They usually charge around 1-2 percent of assets managed each year.

Index funds, on the other hand, use passive management, where computers simply and methodically pick the same stocks that an index holds in an attempt to match the market. Index funds have lower fees than mutual funds, as there is no expensive staff to pay.

Let's say Vanguard's S&P 500 index fund has an expense ratio of only 0.14 percent. In an example shared by John Bogle, the Vanguard founder, on the PBS documentary series Frontline, he assumed that two individuals invested in funds with identical performance over 50 years, but one paid 2% lower fees than the other. The disparity was staggering - the second portfolio would have lost 63 percent of its potential returns to fees. Even a 1% fee would cost a 28 percent reduction in retirement returns.

Since mutual funds fail to beat the market 75% of the time, it's worth noting that paying high fees for active management is not worthwhile. Instead, learn how you can achieve better results at a lower cost by investing on your own.

Actions to take

Investing Is Not About Picking Stocks

Investing doesn't have to be just for the wealthy. Everyone can create a portfolio that will make them wealthy, regardless of their financial situation.

One effective method for investing is through automatic investing in low-cost funds, which is highly recommended by Nobel Laureates, billionaire investors like Warren Buffett, and most academics. This involves making decisions about how to allocate funds within a portfolio, selecting investments, and setting up automatic contributions.

Investing in low-cost funds and automating investments can lead to lower expenses and reduce the need to constantly monitor the market for the latest stock trends or market fluctuations. It is important to understand that successful investing is not about picking individual stocks but rather about proper asset allocation.

Asset allocation is the most important part of the portfolio that you can control. It's the way one distributes investments between stocks, bonds, and cash. By diversifying investments across different asset classes, you can control the risk in your portfolio and therefore control how much money, on average, you’ll lose due to volatility. Asset allocation is essential for long-term success and is one of the most important decisions you can make in life.

Actions to take

Financial Planning is Essential for a Rich Life

Financial planning is an essential part of building a fulfilling life. It enables people to prepare for their future needs while also creating savings and investment plans for their goals.

Ramit Sethi, the book's author, understood the significance of financial planning before marriage. Back then, he and his wife talked about their future plans, such as how many children they wanted, who would work for them, their ideal lifestyle, and where they wanted to live. After getting married, they took a six-week honeymoon to enjoy their life together.

If you're in your twenties or thirties, investing now can pay off big time later on. Compound interest and tax-advantaged retirement accounts can significantly impact your future wealth. Plus, it's always a good idea to negotiate your salary so you can earn more.

Now, if you're someone with a partner, it's very important to talk about money with them. It can be an awkward conversation, but it's essential to ensure you're on the same page about finances.

When it comes down to it, you've got two choices for getting more money: make more or spend less. Whether you're negotiating a higher salary or creating a financial plan to cut down on expenses, taking control of your finances can help you achieve all your goals.

Actions to take

Don’t just read. Act.